Missed Opportunities: Faster-Responding Auto Retailers Win 8x More Deals, Finds Impel Survey

Syracuse, New York, September 26, 2024 – Despite the fact that digital experiences play a critical role in the car buying experience, dealers continue to struggle with providing timely and complete responses to online shopper inquiries, according to a 1,000-person nationwide survey by Impel. Half of recent car buyers (49%) said that their most recent experience was no better than previous experiences, driven by significant gaps in dealers’ ability to effectively respond to them.

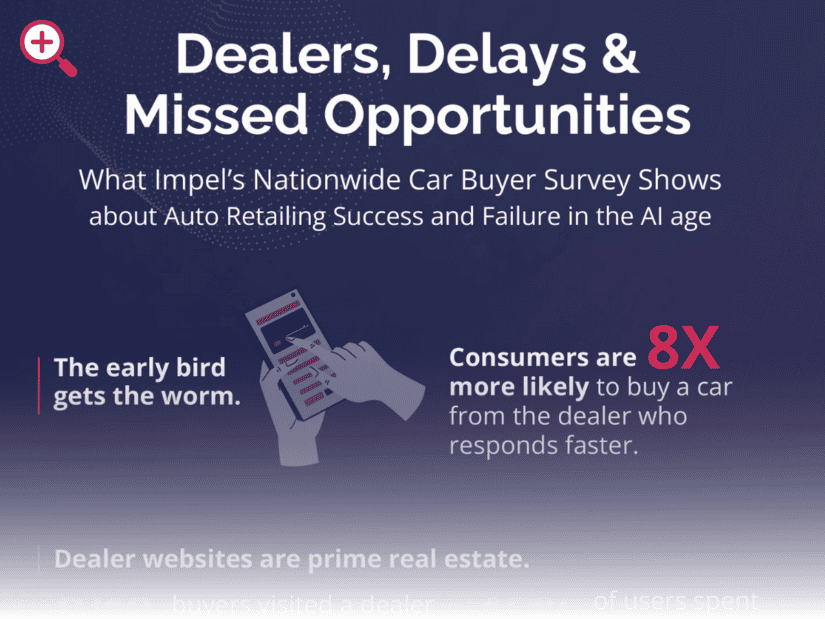

Nearly half of car buyers (45%) reported visiting three or more dealer websites, and 49% spent five hours or more conducting online research before their most recent purchase. One in four buyers (24%) who submitted their contact information received no acknowledgement, and nearly half (45%) had to follow-up with at least one dealership due to a lack of timely response to their questions. Critically, the dealerships that responded more quickly to consumer inquiries won eight times more deals, per the survey.

Impel’s survey provides insight into American car buyers’ online research habits, as well as their perceptions regarding dealer responsiveness and views of AI’s role in the future of automotive sales.

“Consumers continue to conduct a significant amount of the car shopping process online, where competitive alternatives are just a click away” said Impel Co-Founder and Chief Strategy Officer Michael Quigley, whose AI customer lifecycle management platform serves 8,000 dealerships in more than 50 countries. “It’s clear that answering shopper questions quickly and completely has a significant impact on customer satisfaction and business performance. Unfortunately, dealers that continue to run their operations with outdated systems and processes are failing to meet even basic consumer expectations.”

When asked what parts of the car buying process shoppers wanted AI to improve, the most requested enhancements included reducing paperwork (39%), cutting down time spent at the dealership (34%) and providing 24/7 availability to answer questions (30%).

In order to overcome consumer concerns, dealers need to ensure that their chosen AI solution delivers a personal touch (55%), provides accurate information (47%) and demonstrates an understanding of their needs (25%).

Additional survey insights include:

- Both digital and physical showrooms play a critical role for consumers. Nine out of ten car buyers (91%) visited a dealer website before buying or leasing their last vehicle, with nearly half (45%) spending time on three or more dealer sites. More than four out of 5 buyers (84%) visited a physical showroom to test drive a vehicle before buying, and 62% set foot in two or more dealership locations.

- Faster dealer responses win deals 8X more often. Consumers are eight times more likely to buy from the dealership that responds faster to the questions they ask (34% vs 4%). Unfortunately, 58% of car buyers waited for more than an hour to hear back from a dealership after supplying their contact information.

- Lack of dealership follow-up. Two thirds of buyers (65%) shared their contact information with a dealer; however, 24% received no acknowledgement or follow-up from least one dealership.

- Shopper questions aren’t being answered. Nearly half (45%) of car buyers who submitted a question regarding a vehicle of interest had to follow up with at least one dealer due to a lack of response. Only half (50%) of those who received an automated reply were satisfied with the response they received.

- Online chat capabilities have room for improvement. Nearly one in five dealership chat users (19%) were less than satisfied with their experience, driven by issues related to speed, completeness and accuracy of responses, as well as ease of use.

Quigley continued “Relying on human staff, traditional chatbots or basic autoresponders is simply not enough to meet the needs of today’s consumer. Many of the shopper frustrations that still exist in the car buying process, including lack of follow-up and after hours availability, slow response times, and impersonal responses to questions, can be directly addressed with generative AI solutions that are available today. As more consumers experience firsthand the benefits of interacting with AI-enabled retailers, they will increasingly migrate more of their business, and their loyalty, to those businesses that able to leverage the technology to deliver an enhanced customer experience.”

Survey Methodology

Impel commissioned Pollfish to conduct an online survey of 1,000 U.S. adult car buyers who purchased or leased a vehicle from a dealership within the last three years. All figures, unless otherwise stated, are from Pollfish. Fieldwork was undertaken between August 21 – 22, 2024. The survey meets rigorous quality standards and employed a non-probability-based sample using quotas upfront during collection and a weighting scheme on the back end designed and proven to provide nationally representative results.

About Impel

Impel offers automotive dealers, OEMs, and third-party marketplaces the industry’s most advanced AI-powered customer lifecycle management platform. The company’s end-to-end omnichannel solution leverages proprietary shopper behavioral data and generative conversational AI technology to deliver hyper-personalized experiences at every touchpoint. Impel’s fully integrated platform works seamlessly with all major website, CRM, and DMS platforms. To date, the company has delivered 24 billion shopper interactions, influencing more than $6 billion in Sales and Service revenue across 51 countries.